Smart Money Moves: The Power of High-Yield Savings Accounts – Your Complete Guide

You’ve been seeing this term everywhere, no matter where you swipe.

HYSA.

High-Yield Savings Account.

But what are they and why are you seeing this talked about so much along with NOW? This blog post will cover not only these questions but mostly what you need to know about them before you open one and start actively saving (or doing the second part of your spaving). I don’t want you to just open for the shake of opening on (which I would suggest), I want you to maximize your savings.

Legit 82% of Americans don’t have an HYSA per CNBC. It takes 5-10 minutes (you might have to get up to get your wallet to do add your info) to open but can 10X your savings even if you start with $10.

HYSAs are simply savings accounts that pay you more interest compared to a regular savings account that your grandma opened up for you when you were 5. You are seeing so many people talk about these types of savings accounts because people are waking up to how they were getting scammed with regular savings accounts. While they have been around for a good minute, what’s making them the popular kid lately? Jerome Powell and The Federal Reserve.

One is where you paid and one is where you paid. You always want the APY high and the APR low.

So, how are you able to be paid more with these types of accounts than you are with regular savings? The APY or Annual Percentage Yield. This might get mixed up with APR or Annual Percentage Rate when it comes to your Credit Card or Auto Loan. So here’s how you can know the difference between APY and APR:

APY: How much you’re paid in interest by the institution

APR: What you would have to pay to borrow money (loan)

Want more insight on building your emergency fund? Check out this post!

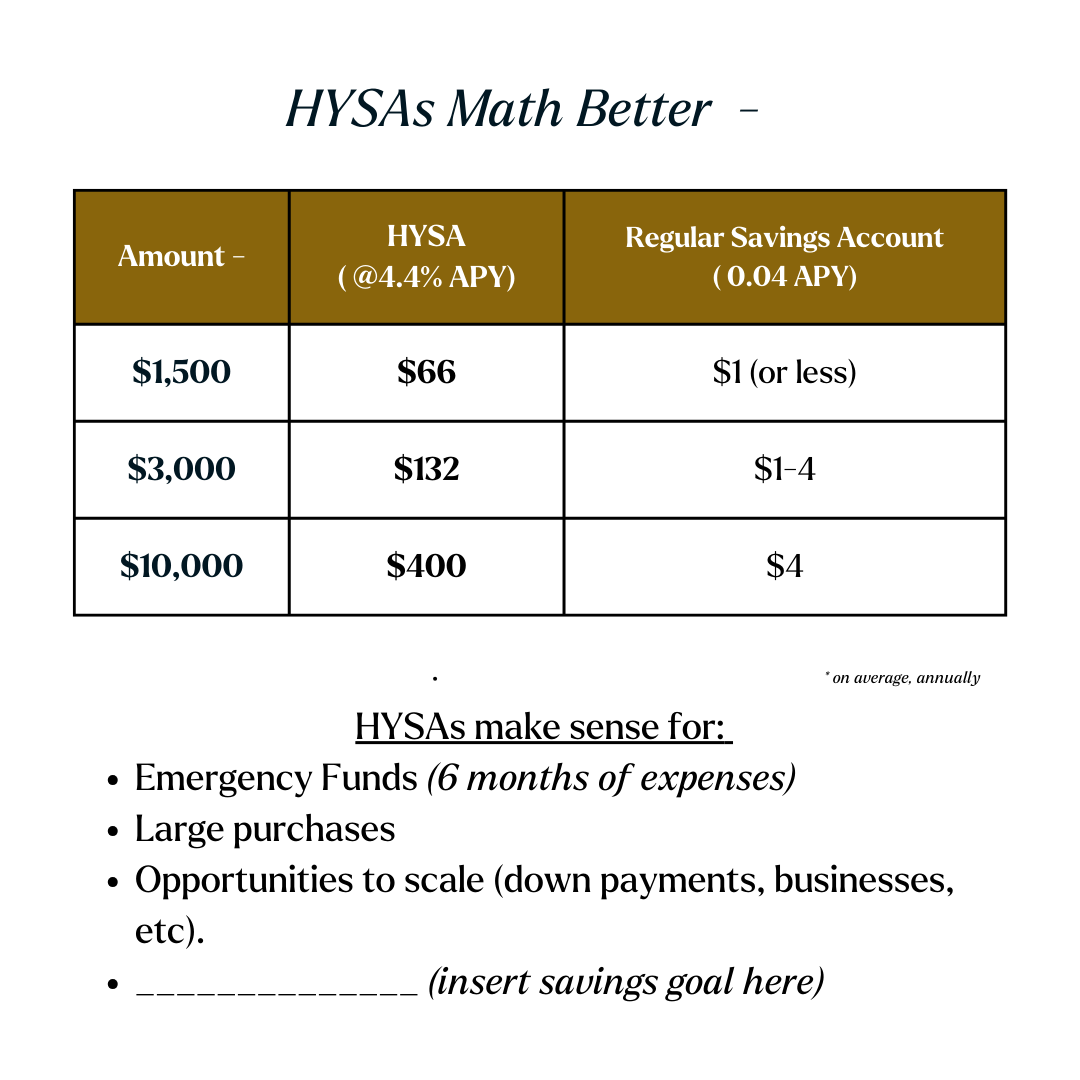

Banks will set the interest paid on certain accounts like HYSAs and CDs that they would pay out to consumers to store their money there over periods of time. During the time I’m writing this, we are seeing HYSAs with APYs of 4% or higher, and this was pushed up from the usual 1.50% or 2%. This was triggered by the Federal Reserve increasing interest rates, which pushed the Prime Rate up. The Prime Rate impacts everything from HYSAs to auto loans to mortgages. The Prime Rate is the interest rate that commercial banks charge their most creditworthy customers. Now that they are talking about cutting the interest rates, the rates on those same accounts would drop. Some people would be happy about the APR on loans going lower, but when it comes to the APY of those HYSAs/CDs, it could go down as well. But I would still pick these types of accounts over the 0.01-0.04% that you can see with regular savings accounts.

What are the benefits of an HYSA?

When it comes to HYSAs, the benefits are pretty straightforward:

Higher Interest Rates: the HYSA rates vs traditional savings accounts are what people look for because you can save the same amount of money and end up with more money in the HYSA due to the interest rate.

Compound Interest: People say that compound interest is one of the wonders of the world, it’s true. When it comes to HYSA, your interest is compounded by not only how much you save but how long it stays - this amplifies earnings over time. Interest from a HYSA is typically paid monthly, but banks can pay interest daily, quarterly, semiannually, or annually. You have a higher return on your savings with HYSAs than traditional savings.

Liquidity: Who doesn’t love cash? These types of accounts give you easy access to funds compared to long-term investments. But you can stack in your HYSA to build toward the long-term (I talked about that here).

FDIC Insurance: Just like other bank accounts - they are FDIC insured up to $250,000 per account. Your deposits are fine.

Hit Goals Quicker: With HYSAs, you can hit your savings goals faster. The reason goes back to why you are saving in these types of accounts - the interest. The interest will push you to that goal even more than just putting it into an envelope or in that shoebox. Gave an example of this here in regards to saving $20K.

Back to the interest, you can calculate your monthly interest rate by dividing your APY

by 12. For example, a 12% APY would give you a 1% monthly interest rate. But, we also have online calculators that adds up the stacks.

Now, what should you look for in these types of savings accounts outside of an APY:

Fees: Just like any bank account that could have fees, some HYSA accounts can come with monthly fees, minimum balance requirements, or excessive withdrawal penalties. These fees can eat into your earnings and make the account less attractive. Look for a HYSA with no monthly fees and a reasonable minimum balance requirement. Currently, due to the Federal Reserve Board's temporary rule, there are no limits on monthly withdrawals from HYSAs.

Access and Convenience: Consider how easily you can access your funds and manage your account.

Online access and mobile banking: Choose a HYSA with a user-friendly online and mobile banking platform for easy account management and transfers.

ATM network: Look for an HYSA with access to a wide network of ATMs to avoid withdrawal fees.

Links to other accounts: If you already use a particular bank for checking or other accounts, consider an HYSA from the same institution for easier transfers and consolidated account management.

When it comes to not only opening the account but optimizing the savings that you would gain from using this more than the traditional, it’s ways that you can do this within your vantage point of budgeting.

Look within your budget to see how much you can save per paycheck – automate it. Develop the framework of it becoming a bill that you must pay and have an overall value (how much you want to save and by what date), and you have to pay it. Yes, paying yourself first while doing it.

When you get a bonus, determine the ratio of treating yourself, paying yourself, and paying those people. That split that you have will help increase your savings even more.

Finding your gap to see gains. I gave this example of when bills or things I buy are less than what I budgeted for, I take that “gap” and move it into my HYSA.

Don’t chase the rate. The longer that you stay within that account and build, the more you will see by the end of your savings goal. The rates can go up and down depending on how Jerome Powell frowns on the Federal Interest Rate (hikes - APY up, cuts - APY down).

For those savings challenges, most of the time you see people tell you to save it in an envelope, which is good to view for motivation but not see the value of it growing as you can within an HYSA. If you need more saving challenges, check out my Pinterest Board.

Having multiple HYSAs is amazing, but I want you to start with one before you build a fist. This could easily be your Emergency Fund, which I talked about here, or any other savings goal. I’ve had people telling me that their budget, income, and expenses will make it hard to save. I get it. Start small and scale allows you to get the idea of saving into the same practice that you may have with spending. You can start with $1 and build to $10 and then $100 and so forth.

Transfer And Taxes — Things To Know

Another thing that many don’t talk about is how long the money could take to transfer from your HYSA to your Checking (when you need it or hit that goal). It could take a minute, but as technology has gotten better it has cut the 5-day or longer wait til down to under 72 hours (business). Also many know about HYSA and expect the same way that you opened up a traditional bank account to happen the same. No walks into the bank, the bank is on your phone and/or laptop. Some people no matter the generation might not like that, but the interest you’re paid will make up for it. Just be mindful of if the app/website is easy for you to use. As a former product manager, banks are starting to take that into account for how people use their products online as much as in branches.

These accounts can also be taxable as income. Yes, with these, too. The government wants your savings (and other taxable accounts like brokerage accounts). But before you stress about filling out extra forms, let's break it down into bitesize pieces.

First things first, the threshold for reporting interest income is $10. That means if your account earns less than $10 in a year, the IRS doesn't require you to report it on your tax return.

However, if your interest haul surpasses that $10 cap, taxes will be taxing. Look at the interest paid on your accounts to pace what you’re doing as far as the potential income of it all. They'll (the bank) send you a document called Form 1099-INT, detailing the total amount of interest you earned throughout the year. Think of it as receipts on your stacking!

Now, onto the juicy question: at what rate is this interest taxed? Rates are usually in line with your normal income tax bracket. So, if you're in the 22% bracket, that same percentage applies to your savings account interest.

Want to see how saving into an HYSA would look like your gains as you grow it? Check out this chart that I shared on Instagram.

Now, which HYSAs would I recommend (and have done so in the past)?

Marcus by Goldman Sachs (this is a referral link, when you click it you get a boost in your APY)

You can find out who has the best rate (APY) over on Bankrate or Nerdwallet; both of them I highly recommend along with the content that I share. To learn more about HYSAs, check out this YouTube:

There will be more blog content around HYSAs and savings in general. The reason for this is that more of us need to know how we can save and how much we can benefit from doing so. Let’s recap a bit a recap about High Yield Savings Accounts:

High-yield savings accounts (HYSAs) offer significantly higher interest rates than traditional savings accounts, allowing you to grow your money faster. This makes them ideal for short-term savings goals, emergency funds, and anyone looking to maximize their returns on low-risk investments.

HYSAs are easy to open and manage, typically with minimal fees and convenient online access. This makes them accessible to a wide range of people, regardless of their financial background or experience.

Choosing the right HYSA requires careful consideration of key factors like interest rate, minimum balance requirements, accessibility, fees, and customer service. You should also explore various resources and compare offers from different banks to find the best deal for your specific needs.

Let me know in the comments what are you saving for right now, how are you progressing and when will you crush that goal.

Want more on this topic? Read these:

[Break] In Case Of Emergency: Rebuilding Your Emergency Fund

Audit Your Wallet: Understanding Your Money

Better Balance: Understanding Your Budget + Finding Your Balance With Money

Basic Build: Common Money Terms To Pivot Your Paper

Crush Your Financial Goals in 2024: Top Apps & Platforms for Budgeting, Investing & More!